12 Ref Contribution Rate Section A. 65 Ref Contribution Rate Section C More than RM5000.

Download Employee Provident Fund Calculator Excel Template Exceldatapro

The primary reason for this revision was.

. Epf contribution table 2022 pdf - New SSS Contribution Table 2022. How to do payroll calculator with pcb. The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector.

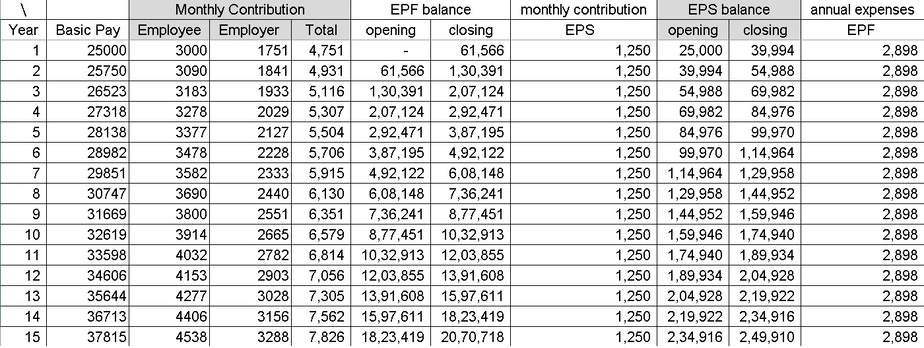

KWSP - EPF contribution rates. This privilege is only for the first three years of employment. Interest on the EPF contribution for April Nil No interest for the first month Interest on the EPF contribution for May 4700 0675 31725.

Employer contribution Employee provident fund AC 1 12. If you are yet to enroll into anything and thinking about what degree that will lead you to 10k. EPF Kwasa Damansara Branch officially opens to the public from 4 JULY 2022 More Info.

Per Annum Conventional. Employees age years Contribution rates from 1 January 2022. Eis contribution rate table 2019 pdf malayars.

Monthly wages 750 By employer. Ref Contribution Rate Section E RM5000 and below. 065 From 01042017 Previous-085 from Jan 2015 or min Rs.

050 EPF Administrative charges AC 2 0. EPF Self Contribution. Contribution By Employer Only.

Employers contribution towards Employees Deposit-linked Insurance Scheme is 050 and the administrative charges are 050. Surah pertama diturunkan di gua hira. Kadar caruman bagi majikan dan pekerja terkini yang berkuat kuasa mulai gaji upah januari 2021 boleh.

EPF Self Contribution is an EPF scheme where registered EPF members may make additional contributions to their EPF savings with any amount and at any time. Employee shall be calculated at the. In the union budget 2018-2019 new women employees can make an EPF contribution of 8 instead of 12.

Slide Slide Slide Slide Slide Slide. The contributions made by employer and employee towards the EPF account is the. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme.

32500 Total EPF Contribution of Flexi is RM55000 Flexi has a salary of RM2000 per month and get a bonus of RM2000 how much does he has to contribute to EPF. The following table summarises the current contribution rates for Singaporeans and SPRs from third year and onwards across the different age groups. In the event you do not meet your cohort Basic Healthcare Sum you will not be required to top up your MediSave Account.

The EPF interest rate for FY 2018-2019 is 865. The EPF interest rate for FY 2018-2019 was 865. For employees who receive wagessalary exceeding RM5000 the employees contribution of 11 remains while the employers contribution is 12.

Im A Member i-Akaun LOGIN. Im An Employer i-Akaun. When wages exceed RM30 but not RM50.

When wages exceed RM50 but not RM70. 02 will be paid by. So the Total EPF contribution every month Rs 6000 Rs 1835 Rs 7835.

Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule. Any degree will do it is a matter of time. Can an employee opt out from the Schemes under EPF Act.

For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. Total monthly contribution towards EPF Rs. Wages up to RM30.

Employers contribution towards EPF 367 of Rs 50000 Rs 1835. To enable women for higher take-home pay To encourage companies to hire more women to bridge the gap. All private sector employers need to pay monthly contributions for each employee.

Monthly contributions are made up of the employees and employers share which is paid by the employer through various methods available to them. And for the months where the wages exceed RM2000000 the contribution by the. The Employees Contribution Rate Reverts to 11 More Info.

CPF Basic Healthcare Sum from 1 Jan 2016. What are the CPF contribution rates. 500- EDLIS Administrative charges AC-22 0.

Assuming the employee joined service on 1st April 2021 contributions start for the financial year 2021 2022 from April. 550 Considering the current EPF contribution rate to be 85 the monthly interest on EPF would be-Now assuming that the employee joined the organization on 1 April 2019 his contributions to his EPF account would be calculated from the financial year 2019 2020. Hendaklah dikira pada 11 daripada amaun upah bagi bulan itu dan kadar.

Same goes to responsibility more responsibility more pay. When wages exceed RM70 but not RM100. This includes salaried employees self-employed freelance worker and anyone who wish to better prepare for their retirement.

The contribution rate of epf 11 percent epf socso way last content caruman kwsp 2019 schedule caruman kwsp 2020 11 peratus download timeline trãªs caruman. 001 or min Rs. According to the eis contribution table 02.

The epf said the latest contribution rates for employees and employers can be referred at the third schedule epf act 1991. Lets use this latest EPF rate for our example. From 1990001 to 2000000 120000 110000 230000.

According to the EPF contribution table. As mentioned earlier interest on EPF is calculated monthly. The amount above the BHS will flow to your Special or Retirement Accounts to increase your monthly payouts.

Instalment Plan More Info. 57200 from 1 January 2019. 13 Ref Contribution Rate Section A Applicable for ii and iii only Employees share.

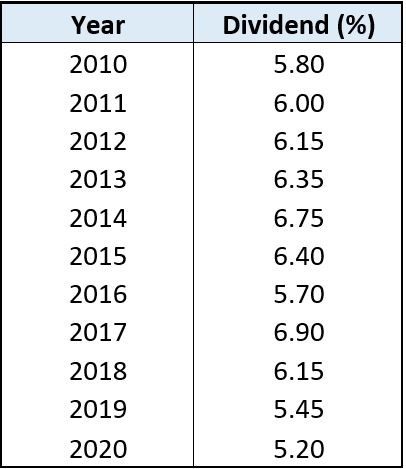

The Employee Provident Fund Organization EPFO after consultation with the Ministry of Finance reviews the EPF interest rates annually. From RM248001 to 250000. Flexi has RM200000 and Wages RM200000.

Employment insurance eis contributions are set at 04 of an employees estimated monthly wage. In General The higher the risk the higher the pay. If you want it to be fast IT is the go to for now.

367 Employees Pension scheme AC 10 0. Employees Deposit linked insurance AC 21 0. From 1980001 to 1990000 119400 109500 228900.

RM200000 RM200000 RM400000. Employees contribution towards EPF 12 of Rs 50000 Rs 6000 Employers contribution towards EPS 833 of Rs 50000 Rs 4165 Employers contribution towards EPF 367 of Rs 50000 Rs 1835 So the Total EPF contribution every month Rs 6000 Rs 1835 Rs 7835.

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf Challan Calculation Excel 2021

Average Savings Of Epf Members At 54 Years Of Age Download Table

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

How To Do Payroll Calculator With Pcb Calculator Via Payroll Software Malaysia

Reduction In Epf Contribution Could Pose As A Risk In The Long Run Business Standard News

Would Multimillionaire Epf Savers Help Poorer Members The Edge Markets

How Epf Employees Provident Fund Interest Is Calculated

Pin On Epf Kwap Ltat Lth Pnb Ptptn

Best Tax Free Bonds To Invest In 2020

Average Savings Of Epf Members At 54 Years Of Age Download Table

Epf In A Low Interest Rate Environment

Tax On Epf Withdrawal New Tds Rule Flowchart Planmoneytax

Epf Contribution Table For Age Above 60 2019 Madalynngwf

30 Nov 2020 Bar Chart Chart 10 Things

What Is The Epf Contribution Rate Table Wisdom Jobs India

Epf Employees Provident Fund Contribution Calculation Otosection

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus